Game7 has released a comprehensive report on the state of Web3 gaming. The research report is based on 1,900 blockchain games and a thousand funding rounds from 2018 through to October, 2023 and includes insights into fundraising, competitive dynamics, and blockchain networks.

Game7 is a booster organization which describes itself as “a community that brings builders and game developers together to accelerate the adoption of Web3 gaming.” The report is free to download here.

The report shows that $19 billion has been funneled into Web3 gaming-related projects since 2018, with almost half that coming in 2022. In 2021, investment was $8 billion. However, that number dropped to $1.5 billion so far this year.

It remains a volatile sector that has yet to entirely bring skeptics over. In 2022, 811 Web3 games were launched, with 14 canceled. The next year, new games launched dropped to 640, with 157 games canceled. So far this year, 223 games have been launched, with 43 canceled.

Market correction

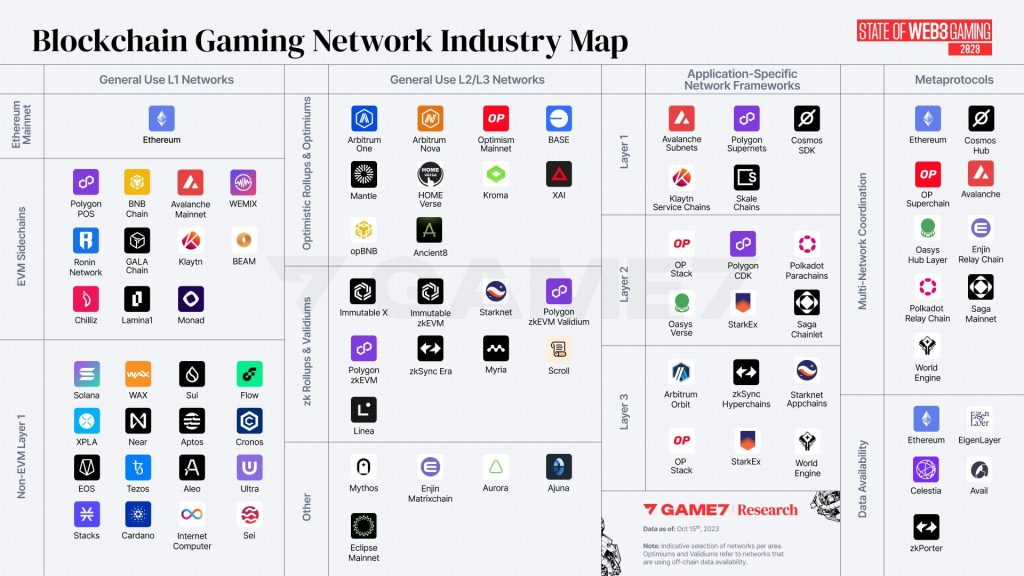

The number of networks targeting Web3 games continues to rise with 53 announced this year, compared to 37 in 2022, and seven in 2021. In 2023, more than 81 new blockchain networks that target gaming were announced, growing by 40 percent year-on-year.

“The Web3 gaming market continues to grow, albeit slower after the 2022 market correction,” states the report. “Until Q3, blockchain gaming-related rounds reached $1.5B in 2023, with more than $800M being exclusive to Web3 gaming, while the rest was shared across multiple verticals.”

In the period overall, US-based Web3 gaming projects ttracted more than $4 billion in funding, with France ($0.9B), Canada ($0.67B), Singapore ($0.67B), and Hong Kong ($0.66B) following.

Regionally, Asia-Pacific takes the lead, as home to 40 percent of Web3 game developers, followed by North America (30 percent), EMEA (28 percent), and Latin America (2 percent). This year, half of the new games entering the space were based in Asia. South Korea contributed to 27 percent of Web3 gaming teams, almost doubling its contribution from last year.

Average funding rounds for game content projects was $10 million this year, down from $14 million last year, and $22 million in 2021. Gaming infrastructure average funding for 2023 was $9 million, dropping considerably from $35 million in 2021.

Genres and platforms

The biggest genres in terms of investment were sports ($1B), MMOs ($1B), RPGs ($0.7B), and action games ($0.3B). In terms of numbers of games, RPGs lead, with 22 percent, followed by action games (17 percent), strategy (15 percent), casual (12 percent), and sports (nine percent).

Games are equally distributed among platforms – roughly 40 percent each among mobile, PC, and browser games, with about 20 percent launched across multiple platforms.

Web3 gaming continues to be dominated by production budgets that are comparatively low to mainstream development. Games with budgets of $10 million-to-$25 million (“AA”) make up about five percent of the market. Indie games developed by small teams constitute 42 percent of the sector while mid-tier productions with funding less than $10 million are at 40 percent.

Four out of five Web3 games are using general-use Layer 1 networks (Ethereum, Polygon etc.) with about two-thirds of games launched this year taking this route. But the report notes that “on the other hand, 51 percent of new networks were either a Layer 2 (42 percent) or Layer 3 (9 percent), mainly driven by the rise of Optimistic L2/L3 solutions”. Application-specific networks, a new breed of blockchain networks for gaming, accounted for 43 percent of the newly launched networks this year, growing 84 percent year-on-year.

Distribution challenges

Web3 games continue to struggle to find mainstream distribution outlets with six out of ten excluded, generally making use of direct distribution (63 percent), Web2 platforms (41 percent), and Web3 platforms (17 percent).

“Most Web3 games remain excluded from mainstream distribution channels, the Epic Game Store has increasingly listed Web3 games influenced by its updated self publication strategy,” states the report. In June this year, Epic Game Store listed two Web3 games, but this number has increased significantly since the summer, now up to 69 games.

Free-to-play games make up 69 percent of the market, followed by NFT-gated games (26 percent) and cryptocurrency-gated at three percent.

83 percent of launches are categorized as games with on-chain assets, meaning that they “utilize blockchain to tokenize fungible and non-fungible in-game assets. Both the game state and the logic are maintained off chain. The game feels almost the same as a traditional game with the key difference being that users can trade their assets using an on-chain ledger”. Hybrid on-chain games make up 12 percent of the market while games that are fully on-chain come in at five percent.

You can read the full report here.

Colin Campbell has been reporting on the gaming industry for more than three decades, including for Polygon, IGN, The Guardian, Next Generation, and The Economist.

GameDaily.biz © 2026 | All Rights Reserved.

GameDaily.biz © 2026 | All Rights Reserved.