How they’re played, who plays them and how people discover the ones they want to play have all seen major changes; 42% of console gamers are now women1; in 2020, millions of existing console owners started playing mobile games2; computers or mobile devices are the primary way that 88% of console gamers discover new games.3

With all of this in mind, we wanted to understand whether the ads that are used to launch these games had kept pace with these changes and whether they were designed for the people now buying games, and the way they discover and buy them.

We at MetrixLab tested 60 console game ads from across the UK & USA using our mobile creative testing methodology. The ads were a mix of lengths, and taken from a back catalogue of ads across many different titles and with a mix of CTAs.

Our test design enabled us to assess attention paid to each creative (by passively capturing VTR), evaluate the memorability and recall of the ad by mimicking actual exposure on FB/IG newsfeed, and, finally, understand the attitudinal and behavioral response to each ad by asking respondents to evaluate it against a series of ad-diagnostics. Collectively, we gained a holistic view of how each would work for modern audiences.

Each ad was tested amongst a group of core gamers (four or more console games purchased per year) and broad gamers (less than three purchases per year). Using best practice for this type of testing, each gamer was only exposed to, and asked to evaluate, one console game ad each. Across the 60 ads tested, we spoke to over 6000 gamers.

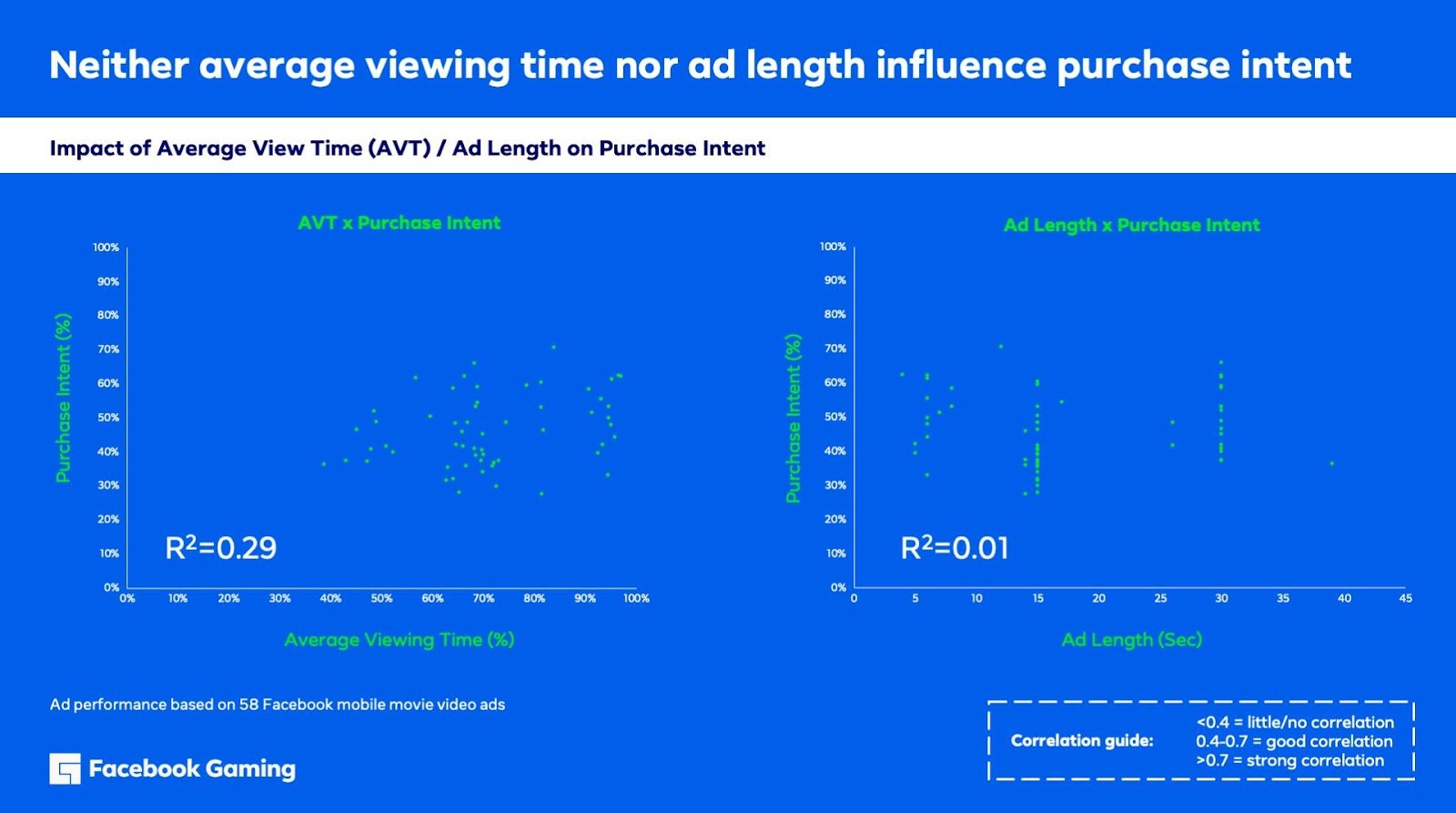

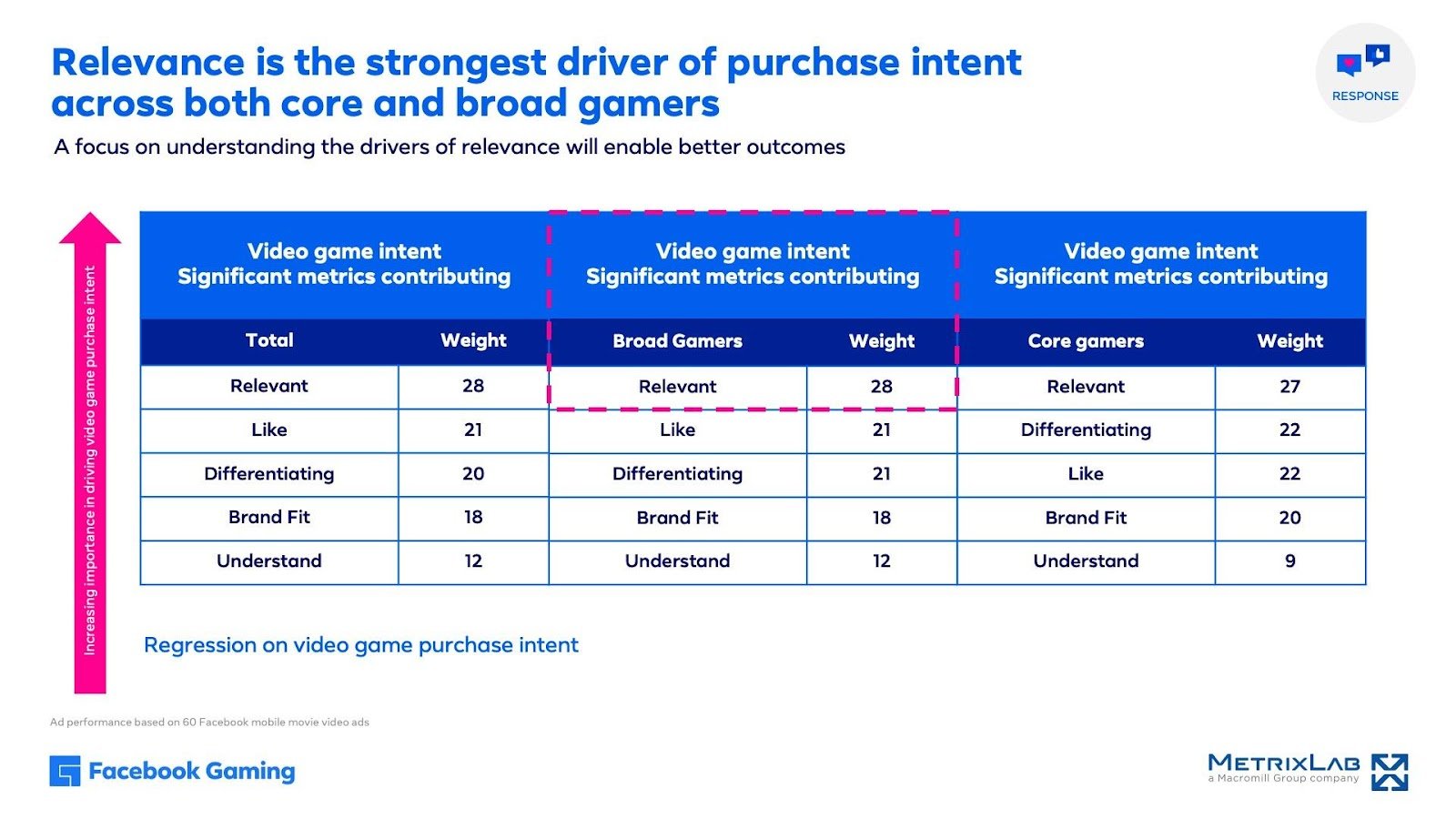

Interestingly, when looking at view time of the ads and viewers’ recall of the ad of the game and their purchase intent, we did not see a direct relationship between average view time, VTR, ad-length, or absolute seconds watched with brand impact.

Put simply, ad length, VTR, and average view times are not in themselves indicators of success. What matters most is what we do with the time we have the audience’s attention. And there are a number of things we identified that can be done to maximize the potential performance of console game ads on newsfeed:

We set out to understand whether the ads for modern console game launches had kept pace with the modern console gamer and how they consume media. And the answer is a clear ‘sort of.’

There is lots of opportunity to test the findings of this research and the tactics it highlights as likely to drive success. But there are also a few clear areas that games marketers should focus on to ensure that their ads are designed to ensure success on mobile, which is where gamers increasingly spend much of their time.4

Not all of these will prove true for every ad, nor even for every game. But by thinking about the modern gamer, how they actually find, evaluate and buy games in 2021, and testing what works best to convince them to buy yours, should result in better trailers and ultimately better sales.

To explore this topic in more depth, the webinar below delves into how gaming audiences are evolving, the research Facebook carried out into Console creative, and most importantly the results and how these can tell us to build better mobile ads. All designed to help you capture your players’ attention early, and keep it. Watch now.

Ciarán Norris, Industry Manager (Console & XP Gaming), Facebook

Ciarán leads the sales team at Facebook supporting the PC & Console gaming industry in EMEA. His experience in marketing spans client-side, media-owner, creative & media agency and dates back to a job in a Sydney internet cafe at the turn of the millennium.

Martin Ash, Group Director – Media and Entertainment, MetrixLab

Martin leads the Media and Entertainment Insight team at global market research firm MetrixLab, supporting the industry in developing audience-led marketing communications strategies.

1 Newzoo – Consumer Insights Games & Esports, 2021 (Base: 33 markets, n= 36,200). 2 Mobile Gaming Behavior Post COVID-19” by Interpret (Facebook IQ-commissioned online survey of 13,246 mobile gamers ages 18+ across BR, CA, DE, FR, JP, KR, UK, US, VN Jul/Oct 2020). 3 Console Gaming Consumer Journey Survey by Kantar Profiles (Facebook-commissioned online survey of 10059 respondents age 18-64, 2020). 4 GlobalWebIndex Q1-Q3 2013 – Q1-Q3 2020 UK (Console Gamers, 2:24-2:40 hrs time spent daily)

GameDaily.biz © 2026 | All Rights Reserved.

GameDaily.biz © 2026 | All Rights Reserved.